Investera i silver- och silvergruvbolag

/)

/)

Om silver: det viktigaste

- Silver har både industriella och monetära egenskaper och är oersättlig för ny teknik.

- Silver är ett bra val för att diversifiera sin portfölj på grund av dess låga korrelation med den breda aktiemarknaden.

- Silver anses vara en säker investering, väldigt likt guld, och fungerar som ett inflationsskydd i osäkra tider.

- Att investera i silvergruvbolag ger exponering mot silverpriset samt det specifika gruvbolaget. Gruvbolagens aktiepris fluktuerar ofta mer än silverpriset vilket gör att man får en hävstångseffekt mot silverpriset.

- Utbudet och efterfrågan på silver är både på kraftig uppgång.

Investera i silver med AuAg idag

ETC:er, fysiskt silver, silverfonder (& ETF:er), derivat (papperssilver), aktier - det finns flera alternativ när man vill investera i silver. Det är däremot en stor skillnad mellan fysiskt silver och papperssilver där marknaden för papperssilver är flera hundra gånger större än den fysiska silvermarknaden; men detta kan naturligtvis förändras i framtiden. Vad gäller fysiskt silver, till exempel silvertackor eller mynt, väljer få att investera i det på grund av dess brist på likviditet och logistiska utmaningar (lagring och transport). Det enklare, billigare och säkrare alternativet är att investera i silverfonder.

Utforska vår sektorfond ─ AuAg Silver Bullet ─ med fokus på investeringar i silvergruvbolag; ett utmärkt alternativ för någon som vill lägga till silverinvesteringar till portföljen. AuAg Silver Bullet består av några av branschens mest hållbara silvergruvbolag och samtliga är utvalda baserat på deras ESG riskbetyg från Sustainalytics.

/)

Fördelarna med att investera i råvaror

Att investera i råvaror har alltid ansetts vara ett bra sätt att diversifiera en portfölj. Detta beror på att det är en tillgång som har en lågt korrelation med den breda aktiemarknaden. Att investera i råvaror som silver, guld eller andra ädelmetaller ger flera fördelar för en investerares portfölj:

- Riskjusterad avkastning. En investeringsportfölj med flera tillgångar ger vanligtvis en högre riskjusterad avkastning.

- Skydd mot inflation. Att investera i råvaror kan vara ett bra skydd mot inflation eftersom råvarupriserna historiskt har ökat under perioder med hög inflation.

Att investera i fysiska råvaror passar dock inte alla. Aktier i bolagen som tar fram råvaror har både för och nackdelar. I slutändan kan ett företag expandera och öka sina vinster, vilket kan leda till en stigande aktiekurs. I jämförelse genererar en råvara inte något kassaflöde; utan det är utbud och efterfrågan på den globala marknaden som styr dess pris.

Om silver

När man investerar i silver får investeraren exponering mot en metall som har både industriella och monetära egenskaper. Silver [Ag] är en ädelmetall med hög motståndskraft mot korrosion och oxidation samt har den bästa termiska och elektriska ledningsförmågan av alla metaller; vilket gör den oersättlig i vår högteknologiska och gröna värld. Silver har också antibakteriella egenskaper som gör det användbart i medicin, vattenrening och andra konsumentprodukter. Det är en unik metall då den är viktig för industrin samtidigt som den används som pengar. Idag finns det inga reservlager av silver, vilket kan resultera i fysisk brist och prisökning. Silver är ofta bara en biprodukt för de största gruvbolagen (enbart cirka 27 % kommer från silvergruvor), vilket kan ge goda förutsättningar för fokuserade silvergruvbolag.

Priset på silver tenderar att stiga vid hög inflation och en svagare USD och har en låg korrelation med börsen. Silver bidrar alltså till riskspridning i en traditionell portfölj av aktier och räntetillgångar. Likt guld tenderar också priset på silver att stiga i tider av marknadsoro när riskaversionen på marknaden är hög. Silverinvesteringar har historiskt visat sig vara ett effektivt sätt att skydda en traditionell portfölj av aktier och obligationer.

För att en hög riskjusterad avkastning kan det vara en god idé för långsiktiga investerare att sätta upp en plan för att investera i silver. Att investera i silver 2024 är en möjlighet att få exponering mot två globala trender, skapandet av skulder och krediter, samt omställningen till en grönare värld.

Hur och var används silver?

Silver förknippas ofta med lyxvaror som smycken, bordsserviser och konst. Däremot så används majoriteten (ca 55%) av silvret idag som en industrivara. Den används flitigt i en mängd snabbväxande elektroniksegment som solpaneler, LED-belysning, flexibla displayer, pekskärmar, cellulär teknik och vattenrening.

/)

Är silver en bra investering?

Silver anses en bra investering av samma anledningar som för guld och andra ädelmetaller:

- Avkastning: Silverpriset tenderar att följa guldpriset men med större svängningar. Alltså har metallen en stor avkastningspotential.

- Värdebevarare: Likt guld kan silver behålla sitt värde och till och med öka över tid.

- Diversifiering: Silver är en bra diversifiering i en portfölj eftersom det har låg korrelation med den breda aktiemarknaden.

När ska man investera i silver?

Priset på silver är volatilt eftersom marknaden är relativt liten. Tidpunkten för när du bör investera i silver är beroende av marknadsklimatet och dina investeringsmål. Det kan därför vara en god idé att sätta upp en månatlig återkommande investering med ett fast belopp.

Baserat på vår erfarenhet anser vi att investerare bör överväga att investera i silver i följande scenarion, när du:

- behöver ett pålitligt skydd mot monetär inflation,

- vill få exponering mot råvaror, eller

- vill ha exponering för en vara som är kritisk för omvandlingen till en grön värld.

Att investera i silvergruvbolag

Det finns nödvändigtvis inte något "bästa sätt" att investera i silver 2024. Allt beror på den aktuella marknaden, din egen ekonomiska situation och vad du vill uppnå med din investering. Det finns flera fördelar och nackdelar med att investera i fysiskt silver. En investerare avlägsnar motpartsrisken helt och hållet genom att investera i fysiskt silver, men samtidigt behöver du ta hand om lagringen och skyddsförvaringen på egen hand. Men om du är ute efter en enkel och omedelbar investering i silver, är fonder i silvergruvbolag vanligtvis ditt bästa alternativ.

Silverfonder för gruvbolag är hållbara investeringar för i stort sett alla och erbjuder en rad fördelar för alla typer av investerare, till exempel:

- Portföljdiversifiering: Silvergruvbolagens låga långsiktiga korrelation med den breda aktiemarknaden bidrar till en högre riskjusterad avkastning i en portfölj som till stor del består av aktier och räntor. Detta gör dem till en värdefull källa till diversifiering i din portfölj.

- Råvaruexponering genom aktier: Silvergruvbolag är starkt korrelerade med priset för silver. Detta ger investerare exponering mot silver utan att behöva köpa fysiska metaller eller pappersderivat.

- Skydd mot inflation: Silverpriset har, likt guldpriset, ett omvänt förhållande till mängden pengar som skapas. Detta kommer över tid ge investerare skydd mot inflation.

- Finansiell tillväxt: Investerare kan få exponering mot råvaror som guld och silver genom att investera i silvergruvbolag. Detta ger ett flertal fördelar, bland annat att man som investerare får utdelningar som betalas av gruvbolagen. Man får även exponering mot det individuella gruvbolagets drift och tillväxt från aktiviteter som utveckling av nya gruvor.

- Hävstångseffekt mot silverpriset: Att investera i silvergruvbolag ger investerare en hävstångseffekt mot silverpriset – vilket du inte får om du köper fysiskt silver. Aktiekursen för silvergruvbolag tenderar att öka mer än priset på silver när silverpriset är på uppgång och vice versa.

Jämförelse mellan silver och guld

Silver kallas ibland för "den fattiges guld", men det är allt annat än en billig proxy till guld. Det är en mer volatil ädelmetall än guld eftersom silvermarknaden är mindre samt att den kan användas som både en investering och en industriell metall.

Likt guld anses investeringar i silver vara ett portföljskydd, eftersom silver både är en real tillgång och en värdebevarare. På samma sätt betraktas silver som ett skydd mot inflation, även om det ofta hamnar i skuggan av guld som investeringsalternativ. Investeringar i silverfonder som fokuserar på gruvbolag kan dock erbjuda möjligheter till betydande överavkastning, delvis beroende på dess volatilitet. När man överväger investeringar i antingen silver eller guld är det viktigt att beakta de centrala skillnaderna mellan dessa metaller, alltså silvrets omfattande industriella användning, metallernas relativa marknadsstorlekar och deras korrelation med andra tillgångsklasser.

Likt guld anses investeringar i silver vara ett portföljskydd, eftersom silver både är en real tillgång och en värdebevarare. På samma sätt betraktas silver som ett skydd mot inflation, även om det ofta hamnar i skuggan av guld som investeringsalternativ. Investeringar i silverfonder som fokuserar på gruvbolag kan dock erbjuda möjligheter till betydande överavkastning, delvis beroende på dess volatilitet. När man överväger investeringar i antingen silver eller guld är det viktigt att beakta de centrala skillnaderna mellan dessa metaller, alltså silvrets omfattande industriella användning, metallernas relativa marknadsstorlekar och deras korrelation med andra tillgångsklasser.

- Industriell användning av silver står för ca 55 % av dess årliga efterfrågan. i jämförelse har guld endast ca 8-9% av sin efterfrågan driven av industriell användning; resten används till smycken och guldtackor. Guld betraktas med andra ord som en mer renodlad ädelmetall, medan priset på silver påverkas av både efterfrågan som ädelmetall och från den industriella marknaden.

- Den globala guldmarknaden är den största ädelmetallsmarknaden med stor marginal. Den är ungefär tre gånger så stor som den globala silvermarknaden.

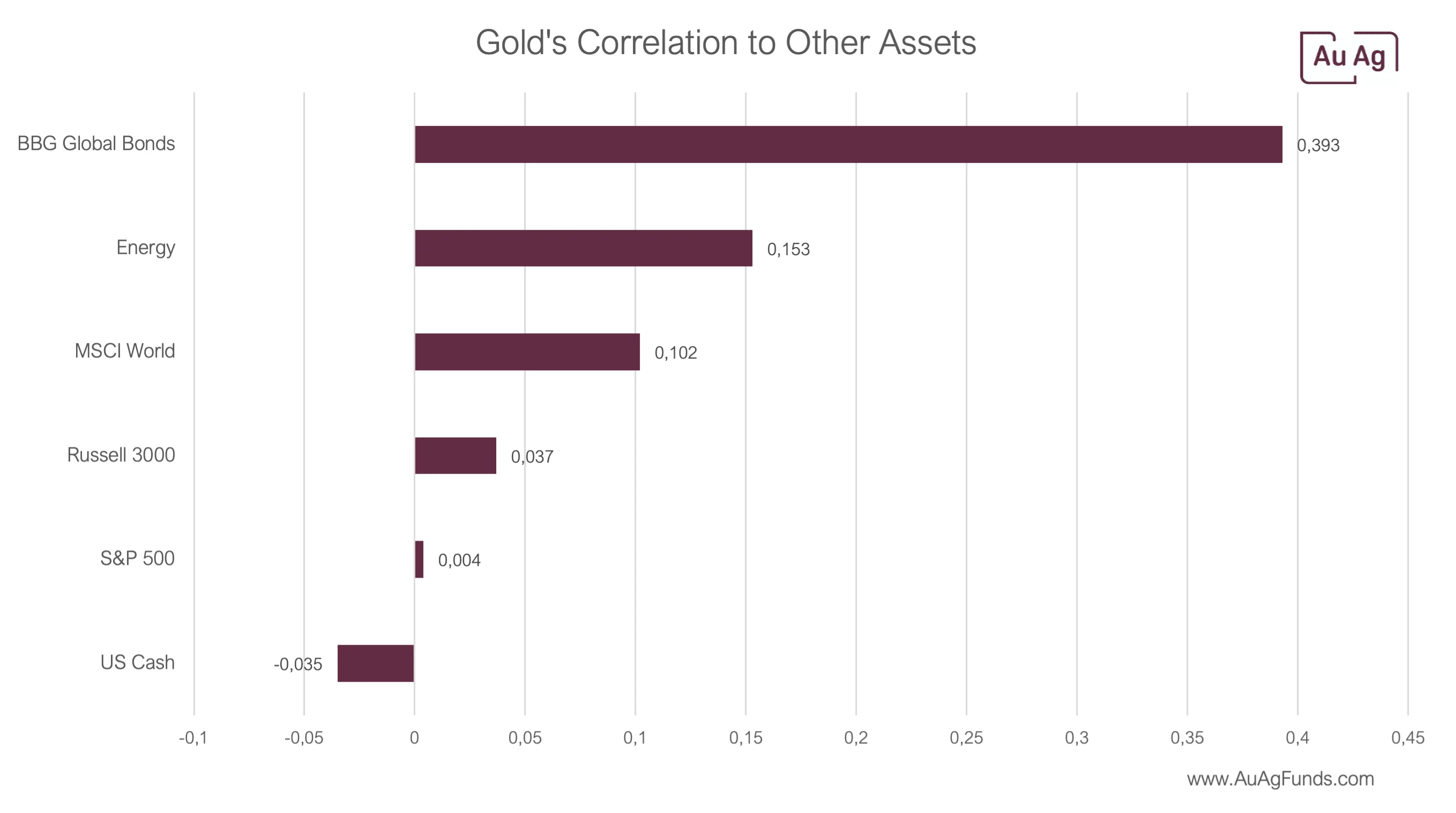

- Guld och silver har också en låg korrelation mot andra tillgångsslag. Guld och silver är starkt korrelerade med varandra (0,76), som visas i diagrammet nedan. Silver har också en högre korrelation med S&P 500, i jämförelse med guld, vilket främst beror på att det används mer inom industrin.

Guld/Silver-ratio

Guld/silver-ratio, eller guld/silver förhållandet, är en ofta citerad siffra som representerar mängden silver som krävs för att köpa en ounce/uns (30 gram) guld. Ration visar priserna i förhållande till varandra och kan indikera när den ena eller andra är billigare eller dyrare än vanligt. I modern tid ligger det genomsnittliga prisförhållandet mellan de två på cirka 55:1. Under Covid-19-pandemin (2020) nådde den en ny topp på 123.34:1 som med stor sannolikhet hände på grund av att investerare valde att investera i guld för dess ekonomiska stabilitet.

Hur man investerar i Silver 𑁋 silverfonder, aktier, ETCs

Fysiskt silver

Du kan köpa den fysiska metallen och förvara den hemma eller på ett annat säkert ställe. Det är billigast/enklast att använda ETP:er [ETC] som finns att köpa på de flesta plattformar där du kan köpa aktier och fonder, t.ex. Avanza och Nordnet för er som vill komplettera portföljen med en rak 1:1 exponering mot silver. Se till att produkterna har tilldelats fysiskt guld och ingen motpartsrisk. En ETC konstrueras också via en SPV vars tillgångar är helt separata från utfärdarens tillgångar.

ETCs (Exchange Traded Commodities)

Genom att köpa en ETC äger du fysiskt silver, men du behöver inte sköta förvaringen själv.

Derivat

Investeringsprodukter som följer priset på silver, men där du har en motpartsrisk mot utgivaren av produkten.

Aktier

Aktiekursen för gruvbolag som utvinner silver är starkt kopplad till avistapriset för silver. Gruvbolagsaktier rör sig ofta mer än priset på den underliggande tillgången eftersom man också lägger till en företagsrisk. Det gör att aktien går upp mer när silverpriset går upp och vice versa.

Det är också viktigt att förstå att silvergruvbolag främst bryter silver, men också andra metaller de hittar. Omkring 60-70% av alla brutna metaller består av silver, resten består ofta av guld, koppar eller andra metaller. Detta betyder för dig som investerare att du också får exponering till priser för andra metaller genom att investera i ett silvergruvbolag - vilket diversifierar risken i din portfölj.

Råvarufonder

Det finns olika typer av fonder för att investera i silver. När du investerar i en fond betalar du en avgift för att en expert (fondförvaltare) ska välja ut de underliggande tillgångarna som ger exponering mot silver. En fond kan inkludera något av alternativen som anges ovan. Det finns två typer av fonder:

- Dagligt omsatt fond: Ofta aktivt förvaltad, vilket innebär att en expert granskar innehaven och balanserar om med jämna mellanrum.

- Exchange Traded Fund (ETF): En värdepappersportfölj som följer ett index och handlas som en aktie.

Pris på silver

Silver prissätts i USD som standard. Detta gör det viktigt för en investerare att förstå prisförändringar på USD i relation till valutan investeraren handlar i. Om du till exempel lever i Europa och investerar i euro (€) så kommer eurons relativa värde i relation till USD påverka dina investeringar. En stark USD i relation till andra valutor blir dyrare för innehavaren av den svagare valutan för att köpa silver. Detta innebär att avistapriset av silver prissatt i USD kan sjunka i en valuta, men öka i en annan. Följ denna länk för att se en live-graf på silverpriset.

Att investera i silver 2024

Data från The Silver Institute indikerar att efterfrågan på silver är på uppgång. Dels på grund av ökad efterfrågan från industrin kopplad till den gröna omställningen. Men även på grund av den monetära inflationen - skapandet av skulder och krediter i det finansiella systemet.

Den gröna omställningen

Silver har en central roll i utvecklingen och produktionen av grön teknik. Det finns många bilkomponenter i elbilars elektroniska system inklusive, bl.a. kablar, säkerhetsbrytare, säkringar, strömbrytare och reläer. Silvers överlägsna elektriska egenskaper gör det till en svår metall att ersätta med andra material. Silver spelar en lika viktig roll i produktionen av solpaneler, batterier och annan teknik.

Monetär inflation

Under de senaste åren har vi sett en rekordstor ökning i balansräkningarna från världens centralbanker. Det började under den senaste finanskrisen 2008 och har fortsatt öka sedan dess. Corona-pandemin resulterade i att detta eskalerade ytterligare även då USA:s centralbank skapade en femtedel av alla dollar som någonsin skapats under 2021.

De ekonomiska skadorna från kriget i Ukraina kommer att bidra till en betydande avmattning av den globala tillväxten 2022 och öka inflationen. Både bränsle- och livsmedelspriserna har ökat snabbt. Enligt IMF förväntas den globala tillväxten avta från 6,1 % 2021 till 3,6 % under 2022 och 2023. Silver, guld och andra ädelmetaller är relativt motståndskraftiga mot inflation eftersom de har ett inneboende. Men på grund av silvers efterfrågan från både industri och investerare, samt att silvermarknaden är mindre, fluktuerar värdet på silver vanligtvis mer än guld.

/)

Slutsats

Silver har både monetära och industriella egenskaper, vilket gör det till en oersättlig metall för vår högteknologiska och kommande gröna värld. Att investera i silver är likt guld ett tillförlitligt sätt att skydda mot inflation. För investerare som vill ta sig in på silvermarknaden är det värt att överväga att investera i silver genom gruvbolag snarare än att investera i själva metallen.

Detta är för att företag kan expandera på grund av operationell excellens och öka sina vinster, vilket leder till att investerare pressar aktien högre. Däremot genererar en fysisk vara inte pengaflöde; den enda anledningen till att priset ändras är att någon vill betala mer eller mindre för det.

På grund av silvers volatilitet och beroende av olika branscher är det nästan omöjligt att förutse hur silvermarknaden kommer att se ut i framtiden. Därför rekommenderas att investera ett återkommande fast belopp varje månad. Att investera i silver 2023 genom världens bästa gruvföretag med AuAg är gynnsamt för din portfölj, silvergruvbolagssektorn och vår värld.

Varför investera i silver med AuAg Fonder?

AuAg Fonder erbjuder fonder som fokuserar på att ge exponering mot ädelmetaller och element inom grön teknologi. Gemensamt för dem är att dessa tillgångar ger skydd mot monetär inflation och är nödvändiga i omställningen till en grön värld – trender som är högaktuella idag.

AuAg Fonder erbjuder exponering mot silver både via dagligt handlade fonder och en ETF. Fonden, AuAg Silver Bullet, investerar i silvergruvbolag, medan AuAg Gold Mining investerar i guldgruvbolag. Genom att investera i guld- och silvergruvor får fonderna en hävstångseffekt mot priset på guld och silver.

/)